Santai Dan Sampah

Guide You To Biggest Insurance Demanding In Our Stock Market Worldwide

Suami "Celaka" Bawak Lari Anak Thailand! NIat Sebenar Nak Ajar Tomoi?

Organizers ought to have innovation redesigns in their sights, in light of the fact that these advanced disruptors are changing what customers request from their guides — man or machine.

InvestmentNews brought eight representative merchant experts together at the Technology Tools for Today meeting in Weston, Fla., on Nov. 2 to talk about, in addition to other things, whether advanced counsel is a danger to fragile living creature and-blood-counselors.

"In the event that the quality suggestion of the consultant is absolutely resource administration or speculation administration, then I think they have some hard pondering what esteem they give," said Joe Simpson, executive of data innovation at Securities Service Network. "It's difficult to legitimize charging 1% or 1.25% on those advantages when you can get it for zero for the same essential usefulness."

Since March, Charles Schwab's retail robo-stage, Intelligent Portfolios, has charged customers 0%. Numerous others charge customers a small amount of a percent, a great deal not as much as normal consultant expenses.

Guides will need to separate themselves from computerized suppliers by helping customers with issues robo-stages don't touch today, for example, resource tilting, school investment funds, legacy charges and different concerns, said Darren Tedesco, overseeing accomplice for development and system at Commonwealth Financial Networ

Harga Minyak 2016 Yang Membuatkan Anda Tak Balik Kampung

Harga Minyak 2016 Yang Membuatkan Anda Tak Balik Kampung

#Investors may want to gain exposure to oil for their individual retirement accounts (IRAs) or Roth IRAs,.,. With the advent of exchange traded funds (ETFs), as well as stocks in traditional oil companies, investors can tailor their oil investments to fit their specific risk profiles,.,.

--------

--------

Oil As an Inflationary Hedge

%%%%%%%%%%%%%

Investors who are saving for retirement may want to gain exposure to oil as an inflationary hedge for their portfolios,.,. Some financial experts see holding oil, and commodities in general, as a way to protect investments against the negative impact of inflation,.,. An inflation hedge can help to insure a portfolio against the risk of inflation,.,. An increase in oil is thought to be a sign of an inflationary environment,.,.

ETFs That Track the Price of Oil

Investors may want to gain straight exposure to the price of oil,.,. There are a number of ETFs that track the price of oil,.,. These ETFs allow for commodity exposure without having to trade a futures contract,.,. The trading of futures involves significant risk due to the leverage involved and is generally not appropriate for IRAs,.,. Although some custodians do allow the use of IRAs for futures trading, most major banks and IRA plans do not allow futures trading in IRAs,.,.

----------------------------------

The most popular and liquid ETF that tracks oil is the United States Oil Fund, which holds only front-month futures contracts on WTI crude oil,.,. The fund’s investment objective is to track the daily percentage change in the price of oil,.,. The fund rolls its position in the front-month contract to the next month within two weeks of expiration of the contract,.,. The fund may also invest in forwards and swap contracts based upon the price of oil,.,.

The United States Oil Fund began trading in April 2006,.,. It has $2,.,.83 billion in assets under management (AUM) with an expense ratio of 0,.,.66%,.,. This expense ratio is fairly reasonable considering the fund has to endure the expense of rolling the futures contracts on a monthly basis,.,. The fund is very liquid, with an average daily trading volume of $390 million,.,. This ensures that investors are able to enter and exit positions easily,.,.

Since it tracks the price of oil, the United States Oil Fund does have a substantial degree of volatility,.,. The fund has a higher beta of 1,.,.59 with a large standard deviation of 28,.,.69 as of November 2015,.,. This higher volatility is due to the large drop in oil prices from 2014 to 2015,.,.

There are also leveraged ETFs that track a multiple of the price of oil or provide performance inverse to the price of oil,.,. For example, the VelocityShares 3X Long Crude Oil exchange-traded note (ETN) provides 3x long exposure to an index that includes only front-month futures contracts for WTI crude oil,.,. This ETN began trading in 2012,.,. The fund has around $985 million in AUM with an average daily trading volume of $234 million as of November 2015,.,. The fund has a high expense ratio of 1,.,.35%,.,.

Leveraged ETFs are prone to having higher expense ratios because they require more active trading and position management to provide the leveraged performance,.,. The VelocityShares 3X Long Crude Oil ETN is not intended to be a long-term investment vehicle,.,. The fund's high volatility combined with the high expense ratios entails a substantial degree of risk that is higher than most investors are willing to withstand in their retirement accounts,.,.

Oil Sector ETFs

Another way for investors to gain exposure to the price of oil is through ETFs that hold the stock of companies in the oil and energy sector,.,. Stocks in the oil and energy sector have a high correlation to the price of oil,.,. These funds are an easy way for investors to gain exposure to the energy sector,.,. They are diversified, which can reduce the volatility of the investment compared to holding the stock of a single energy company,.,. Further, holding stocks in the energy sector offers the possibility for earning dividends on the stock,.,. This is a major advantage over ETFs that merely track the price of oil and offer no opportunity for a regular income stream,.,.

The most prominent energy sector fund is the Energy Select Sector SPDR ETF,.,. This fund tracks a market-cap weighted index of energy companies in the S&P 500,.,. The ETF has over $11 billion in AUM and pays a dividend yield of 2,.,.9% as of November 2015,.,. It has a very small expense ratio of 0,.,.14%,.,. Exxon Mobil is the fund's largest holding, with a weighting of 16,.,.91%,.,. The second-largest holding is Chevron, with a weighting of 13,.,.11%,.,. Schlumberger is the third-largest holding at 7,.,.74%,.,. The Energy Select Sector SPDR ETF offers an easy and inexpensive way to gain exposure to large-cap space for energy companies,.,.

Individual Oil Company Stocks

Investors may also hold the stocks for individual oil companies in their IRAs,.,. This allows investors to pick their specific holdings,.,. Investors may want to look at companies in the mid- or small-cap space that can allow for greater price appreciation,.,. Some investors may wish to pick the part of the oil industry in which they make their investments,.,. Since the oil industry is so massive, there are many types of companies up and down the supply chain,.,. Income-oriented investors may want to focus on companies that pay high dividends currently, or companies that are likely to grow dividends in the future,.,.

Skilled investors may be able to spot individual oil companies that have great potential for price appreciation,.,. However, a concentrated holding also entails greater risk,.,. This is especially true for companies that are actively producing oil, since there could always be an oil spill or another environmental accident,.,. This type of incident can have a drastic impact on the price of one company's stock,.,.

As an example, BP's stock actually held on fairly well right after the Deepwater Horizon incident in April 2010 by staying steady at around $62 per share,.,. Analysts were hopeful that the company could withstand the adverse impacts of the incident,.,. However, the stock eventually fell to around $27 a share by that June as it became clearer that damages and lawsuits were going to pile up,.,. Holding an individual oil stock does allow for the possibility of greater return, but it may be riskier,.,. Once again, investors need to consider their individual risk tolerances when deciding what types of oil investments to make in their IRAs,.,.

Siapa Ajar Awak Nak Pertahan Diri Boleh Bunuh Orang?

Siapa Ajar Awak Nak Pertahan Diri Boleh Bunuh Orang?

---

---------------

#Khalid berkata demikian bagi mengulas siasatan berhubung keputusan untuk mendakwa seorang lelaki yang membunuh perompak ketika cuba mempertahankan dirinya di Terengganu.

#Pertuduhan itu mencetuskan kemarahan di kalangan netizen.

#Khalid juga mempertikaikan peranan Majlis Peguam dan peguam hak asasi manusia kerana tidak mendidik orang ramai mengenainya.

#"Jika seseorang merompak kita, itu tidak bermakna kita boleh membunuhnya.

"Seksyen 99 Kanun Keseksaan menyatakan dengan jelas had untuk mempertahankan diri, bukan hanya kepada orang ramai tetapi kepada kita juga (polis).

***"Apabila ia melibatkan perkara lain, Majlis Peguam pantas mengeluarkan kenyataan tetapi mengapa senyap mengenai perkara ini?

***********

"Disinilah Majlis Peguam memainkan peranan dalam mendidik orang ramai," katanya di Bukit Aman pada Khamis.

Khalid berkata hak untuk mempertahankan diri tidak meliputi melakukan lebih banyak kemudaratan berbanding yang sepatutnya.

Baru-baru ini, netizen marah apabila berita mengenai seorang lelaki yang dikenali sebagai Zulkifli yang didakwa bakal menghadapi hukuman gantung sampai mati selepas menikam seorang perompak yang memecah masuk ke dalam rumahnya di Kerteh, Terengganu, tersebar di media sosial.

Menurut laporan itu, pemuda itu didakwa mengikut Seksyen 302 Kanun Keseksaan kerana membunuh dan Seksyen 326 kerana sengaja mendatangkan kecederaan dengan senjata berbahaya atau cara lain.

Tunggulah Balasan Daripada Allah Wahai Hakim Dunia!

Tunggulah Balasan Daripada ALLAH Wahai Hakim Dunia!

---

---------

#United States Oil Fund

The United States Oil Fund (NYSEARCA: USO) was issued on April 10, 2006, with the sponsorship of the United States Commodity Funds LLC,.,. The United States Oil Fund is managed by Brown Brothers Harriman & Company and charges an annual expense ratio of 0,.,.72%,.,. As of Nov,.,. 5, 2015, the fund has total net assets of $2,.,.75 billion,.,. It provides exposure to West Texas Intermediate (WTI) light, sweet crude oil and primarily invests in front-month futures contracts on the commodity,.,. Additionally, it may invest in other oil-related futures contracts, forwards and swap contracts,.,.

The United States Oil Fund is one of the most heavily traded oil-related exchange-traded products,.,. Based on trailing three-month data, it has an average daily volume of 29,.,.85 million shares,.,. As of Sept,.,. 30, 2015, the fund has an average annual return of -78,.,.22% since its inception,.,.

#VelocityShares 3X Long Crude Oil ETN

The VelocityShares 3X Long Crude Oil ETN (NYSEARCA: UWTI) was issued by VelocityShares on Feb,.,. 7, 2012,.,. The ETN provides three times exposure to the S&P GSCI Crude Oil Index ER, its benchmark index,.,. As of Nov,.,. 4, 2015, the fund only holds crude oil futures contracts expiring in December 2015,.,.

#Since the fund must rebalance its position frequently to reflect three times exposure, it charges a high annual expense ratio of 1,.,.35%,.,. As of Nov,.,. 4, 2015, the ETN has total net assets of $950,.,.83 million,.,. UWTI is one of the most traded oil-related exchange-traded products and has an average daily volume of 18,.,.29 million shares over the past three months,.,.

ProShares Ultra Bloomberg Crude Oil

The ProShares Ultra Bloomberg Crude Oil ETF (NYSEARCA: UCO) is a leveraged ETF that seeks to provide investment results corresponding to two times the daily performance of the Bloomberg WTI Crude Oil Subindex, its benchmark index,.,. The fund was issued by ProShares on Nov,.,. 24, 2008, and has generated an average annual return of -35,.,.86% since its inception,.,.

UCO is one of the most heavily traded oil-related leveraged ETFs,.,. As of Nov,.,. 5, 2015, based on trailing three-month data, it has an average daily share volume of 7,.,.93 million,.,. The fund primarily holds futures contracts on WTI crude oil and swaps on its underlying index,.,.

Energy Select Sector SPDR Fund

The Energy Select Sector SPDR Fund (NYSEARCA: XLE) was issued by State Street Global Advisors on Dec,.,. 16, 1998,.,. The fund seeks to provide investment results corresponding to the performance of the Energy Select Sector Index,.,. As of Nov,.,. 4, 2015, XLE charges an expense ratio of 0,.,.14% and has total net assets of $12,.,.6 billion,.,.

XLE allocates 81,.,.88% of its portfolio to the oil, gas and consumable fuels sector,.,. Its top holdings include some of the largest oil-related companies in the world, by market capitalization, including Exxon Mobil Corporation, Chevron Corporation, Schlumberger NV and ConocoPhillips,.,. Based on trailing three-month data, XLE has an average daily share volume of 20,.,.36 million,.,.

iPath S&P GSCI Crude Oil Total Return Index ETN

The iPath S&P GSCI Crude Oil Total Return Index ETN (NYSEARCA: OIL) was issued by Barclays on Aug,.,. 15, 2006,.,. The ETN seeks to provide exposure to the S&P GSCI Crude Oil Total Return Index, its benchmark index,.,. The fund charges an expense ratio of 0,.,.75% and primarily holds front-month futures contracts on WTI crude oil,.,. Based on trailing three-month data, the ETN has an average daily share volume of 4,.,.06 million,.,. As of Nov,.,. 4, 2015, it has total net assets of $889,.,.7 million,.,.

VelocityShares 3X Inverse Crude Oil ETN

The VelocityShares 3X Inverse Crude Oil ETN (NYSEARCA: DWTI) was issued on Feb,.,. 7, 2012, by VelocityShares,.,. This ETN seeks to provide three times the inverse of the daily performance of the S&P GSCI Crude Oil Index ER,.,. To provide inverse exposure to its underlying index, the fund primarily holds front-month crude oil futures contracts,.,. Since this fund must be actively managed, it charges a high annual expense ratio of 1,.,.35%,.,.

As of Nov,.,. 5, 2015, based on trailing three-month data, the fund has an average daily volume of 1,.,.62 million shares,.,. It is best suited for highly speculative traders who only seek daily exposure to the inverse of the S&P GSCI Crude Oil Index,.,.

ProShares UltraShort Bloomberg Cru

Labels: insurance

Shahrul Tak Mahu Bertunang! Terus Mahu Kahwin Tahun Depan!

#KUALA LUMPUR: Pelawak dan penyampai radio Era Fm, Shahrol (Shiro) merancang untuk menamatkan zaman dudanya pada tahun depan.

#Bagaimanapun, Shahrol atau nama sebenarnya Shahrol Azizi Azmi, 31, belum bersedia mendedahkan identiti wanita tersebut kepada umum.

#"Insya-Allah, perancangan untuk berkahwin kalau tiada aral melintang pada tahun depan. Saya mungkin akan terus kahwin dan tiada majlis bertunang.

#"Saya mengenali wanita tersebut sudah dua tahun dan kalau sampai masanya saya akan beritahu kepada umum," ujarnya kepada mStar Online.

Shahrol ditemui pada sidang media Anugerah Meletop Era 2016 (AME 2016) yang diadakan di Restoran Live House, di sini, pada Selasa.

Neelofa sudah kahwin secara sembunyi?

#Bermula dengan menjuarai pertandingan Dewi Remaja 2010, nama Neelofa Mohd Noor meniti di bibir peminatnya tahun lepas setelah memperkenalkan satu jenama tudung sendiri iaitu Naelofar Hijab. Tudung Neelofa mendapat sambutan yang amat menggalakkan di pasaran.

Lapor BBC, jualan tudung Neelofa mencecah nilai RM 50 juta tahun ini walaupun terdapat kontroversi mengenai rekaan dan juga isu dengan pengedar tudungnya. Justeru, tidak keterlaluan untuk mengataan Neelofa kini bergelar jutawan hasil peniagaan tudungnya yang laku dan laris bak pisang goreng panas di pasaran.

#Tudung Neelofa dijual di butik sendiri dan melalui 700 orang pengedar sah di seluruh negara. Ia juga dijual dalam talian dan sedia dihantar kepada mana-mana pelanggan di seluruh dunia. Dengan pengedar di pelbagai negara seperti Singapura, Brunei, London, Australia, Belanda dan Amerika syarikat, matlamat Neelofa ialah untuk menjadikan Naelofar Hijab satu jenama global.

Namun agak pelik apabila timbul satu gosip yang mengatakan Neelofa kini menjadi isteri ketiga seorang VVIP yang sudah berusia dan pihak yang mengeluarkan gosip itu mendakwa ia datang dari sumber sahih.

------------

##Mujurlah umah penggosip tidak mudah menerima sesuatu berita tanpa bukti kukuh. Mereka mempertikaikan mengapa pula Neelofa mahu menjadi isteri ketiga seorang VVIP kerana dia sendiri sudah menempa kejayaan dalam perniagaan dan tidak perlu ‘tumpang sekaki’ kejayaan individu lain dengan menjadi isteri ketiga.

------

Persoalan mengenai gosip itu telah diajukan kepada Neelofa di akaun Instagram miliknya oleh seseorang, dan Neelofa mendakwa orang ramai lebih bijak menilai tentang kesahihan gosip seperti itu

##Sabar sajalah Neelofa dengan gosip tidak berasas seperti ini. Setahu kami memang Neelofa menjadi isteri ketiga tetapi itu hanya watak lakonannya dalam telefilem Wan Embong yang disiarkan di slot Cerekarama TV3 baru-baru ini.

Orang berjaya sememangnya dicemburui dan pasti cuba dijatuhkan. Diharap penerangan Neelofa ini menjawab segala persoalan mengenai gosip tersebut.

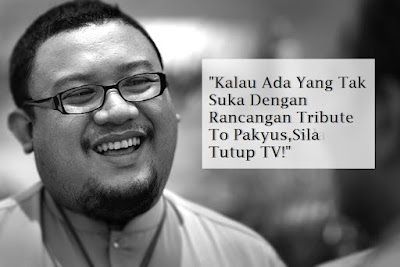

"Kalau Ada Yang Tak Suka Dengan Rancangan Tribute To Pakyus, Sila Tutup TV"

A week prior's appalling terrorist ambushes in Paris were an upgrade that, tragically, the consistent fight with overall terrorism is still with us, and my thoughts are with those impacted by the disaster.

In another paper, "After the Paris Tragedy," the BlackRock Investment Institute starting late shared a couple encounters on how this critical increasing in the power of the terrorist threat could influence the economy and markets proceeding. Here are three of the key core interests.

Scenes of trepidation tend to underline existing budgetary and business part designs, rather than constitute pivotal occasions. The business division impact of past fear scenes, including the 2005 London bombings and 2004 train barraging in Spain, was all things considered vaporous, according to a BlackRock examination of data accessible through Bloomberg. Toward the day's end, the ambushes made elements, get the opportunity to be market thoughts and after that vanished. In the occasion that anything, they inspired the course of the economy and markets. For example, the September 11 ambushes enhanced the 2001 U.S. tech bubble subsidence, however didn't hasten it.

Likewise, in the nearby term, the calamity in Paris is subject to bolster monetary examples adequately in advancement in Europe. The outcome from these ambushes will in all probability put some weight on the French economy and furthermore the euro. A conceivable (yet reversible) scratch in European purchaser sureness should solid game plans by the European Central Bank (ECB) for moreover encouraging measures in December. Meanwhile, France will likely further remove the gravity reins to help hindrance spending, with other European Union (E.U.) people making a move likewise.

The more augmented term impact of Paris could be unmistakable. The purpose behind the Paris ambushes is set up in an intentional breakdown of state control in the Middle East. The range is constant by the consequent results of the Arab Spring, fanatic conflicts and delegate wars between Sunni Saudi Arabia and Shiite Iran, and this cycle may basically be starting, as found in late ambushes on consistent people and the assaulting of a Russian airliner.

With the Islamic State (ISIS) and its branches set on internationalizing their accomplish, the terrorist risk against the West is likely the most shocking it has been ensuing to 2001. If the Paris calamity signify an improvement toward an extended, overall conflict, the business area impact could be considerably more noticeable than past trepidation strikes originating from commonplace conflicts.

In like manner, the Paris fiasco will convolute the path toward a political response for the European banish crisis, and the outcome is still dim. It could provoke close edges and cement the case in the U.K. for leaving the E.U., or then again, we could see more support and mix among E.U. people.

Geopolitics could start influencing markets proceeding. Markets should fight with various political vulnerabilities in 2016. These fuse possible challenges to the European wander regardless of the outsider crisis and risk of more fear ambushes; rising instability in the Middle East at risk to be exasperates by the impact of low oil costs; a Russia and China logically sure abroad while contemplating money related log jams at home; and a U.S. presidential choice with a totally open field of candidates and results.

These perils are playing out against a setting of point of preference expenses propped up by years of bottomless liquidity. Liquidity conditions may be less kind in 2016. The Federal Reserve (Fed) is set to raise advance expenses unprecedented for around 10 years, and the events in Paris aren't subject to change this. Elsewhere, creating business segment national banks and sovereign wealth resources have been putting forth spares and risk focal points for gatekeeper money related gauges and also connection spending arrangement crevices.

This suggests markets are subject to give watchful thought to geopolitics proceeding, and it calls for attentive investigating in 2016. For extra on the sensible results of the Paris fear ambushes, read the full paper from the BlackRock Investment Institute, "After the Paris Trage

Subscribe to:

Comments (Atom)

|| Ketip Sebelum Baca ||

Popular Posts

-

Tunggulah Balasan Daripada ALLAH Wahai Hakim Dunia! #Oil exchange-traded funds (ETFs) provide investors with exposure to com...

-

#SHAH ALAM: Rancangan khas Juara Parodi bagi mengenang pelawak Allahyarham Yus (Jambu) atau Yussry Edoo, 39, yang meninggal dunia pada...

-

y U.S. state and government laws, associations are required to pay Federal Insurance Contributions Act (FICA) costs, pay unemp...

-

Trading choices considering business part records can be a gainful attempt. Nevertheless, monetary authorities have much to co...

-

Siapa Ajar Awak Nak Pertahan Diri Boleh Bunuh Orang? #KUALA LUMPUR: Orang ramai dinasihatkan supaya meneliti peruntukan undang-undan...

-

mohon pihak polis mengambil tindakan segara The best issue money related masters have with Amazon.com, Inc. (AMZN) is valuation. ...

-

Puerto Rico has been experiencing a compelling commitment crisis that continues attacking the locale's economy...

-

Immense quantities of us dream about leaving, yet arriving is from every angle progressively difficult to achieve fiscally these...

-

Precisely when you think you have Medicare all together, it changes. It is the nation's greatest wellbeing net suppli...

-

Aflac Inc. (AFL) – or if you support unmistakable names over their acronyms, American Family Life Assurance Company – made ...